Did you know that the US Department of Housing and Urban Development (HUD) has a best kept secret? The Family Self-Sufficiency (FSS) program is an underutilized resource available in communities across the country designed to help families move away from government assistance.

FSS participants defy the unfair stigma that Section 8 and Public Housing residents are lazy.

Approximately 2.2 million households are eligible to participate in the FSS program; however, only 3% of those eligible participate (~65,000 households).10 In York County, Pennsylvania, there are a total of 65 slots for the FSS program, with approximately 53 slots being utilized in the Housing Authority of the City of York (YHA).7 In addition, the Affordable Housing Advocates has a total of 33 eligible households that can participate in the FSS program, with five currently enrolled.6 Many individuals living in the United States want to achieve the American Dream, to be self-sufficient, own a home, and take care of their family. However, it is not always easy to accomplish these goals on your own, especially when living in poverty or with limited income and resources. Temporary support systems can help households reach financial self-sufficiency, meaning that they are able to provide for their own basic needs (water, food, shelter, etc.) without the assistance of welfare. The FSS program is an excellent example of a support program that makes self-sufficiency possible.

History and Background

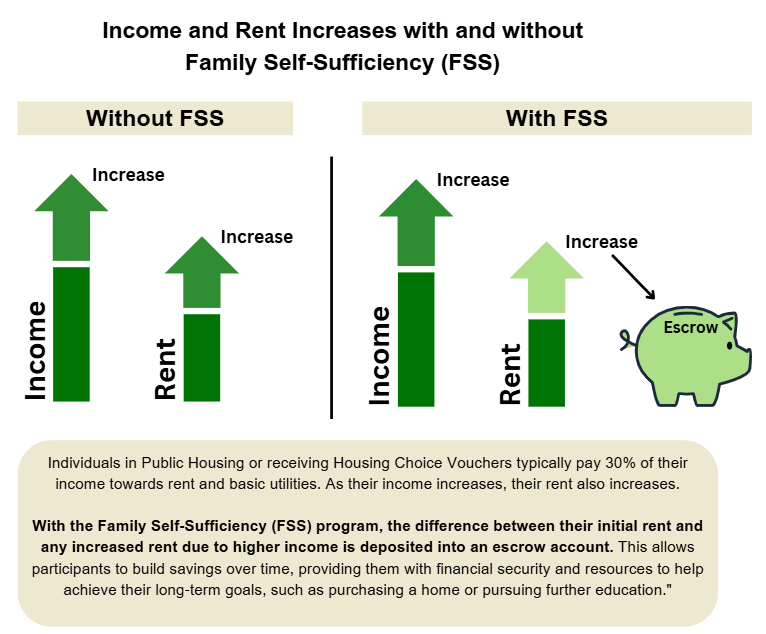

The FSS program was established in 1990 under President George H.W. Bush and former Secretary of HUD Jack Kemp.2 The program started with the aim to help families receiving welfare benefits to become self-sufficient and no longer dependent on federal welfare programs. Since the 1990s, the FSS program has undergone some changes to improve the program for participants.2 The program essentially acts as an incentive for families living in certain housing assistance programs to increase their income and limit their dependency on other welfare programs, such as Temporary Assistance for Needy Families (TANF; cash assistance). By establishing manageable goals designed to increase participants’ income and setting those funds aside in a protected escrow account, the program enables families to build their savings as they find better jobs and earn higher wages. Better still, the escrow account in the FSS program is an interest bearing, non-taxable account that holds funds until the agreed upon conditions are met.3,4 Funds from the escrow account are provided by a grant that matches the change in the participant’s rent as their income increases.7

Figure 1. Income and Rent Increases with and without Family Self-Sufficiency

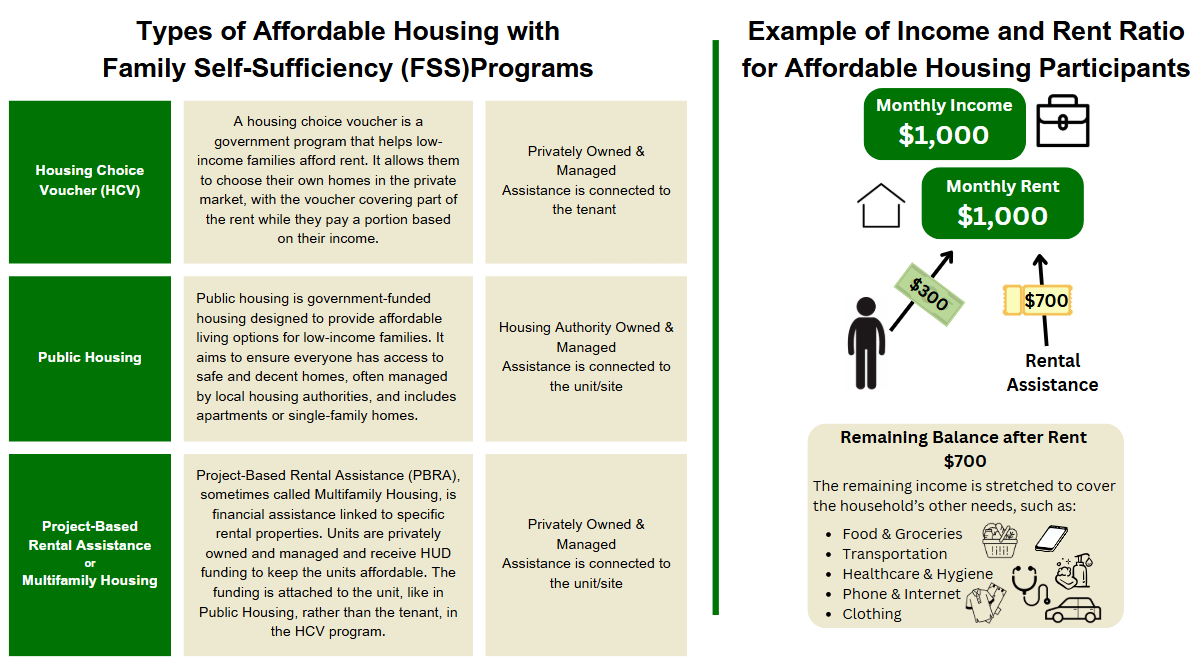

The FSS program is available to households receiving Housing Choice Vouchers (HCV; also known as Section 8/S8) and residents in Public Housing provided by participating housing providers, such as Public Housing Authorities (PHAs).7 In 2022, the FSS program was opened up to Project-Based Rental Assistance (PBRA) properties, also known as Multifamily Housing.6,14

Figure 2. Types of Affordable Housing with Family Self-Sufficiency Programs

Figure 3. Example of Income & Rent Ratio for Affordable Housing Participants

How the Family Self-Sufficiency Program Works

Participants

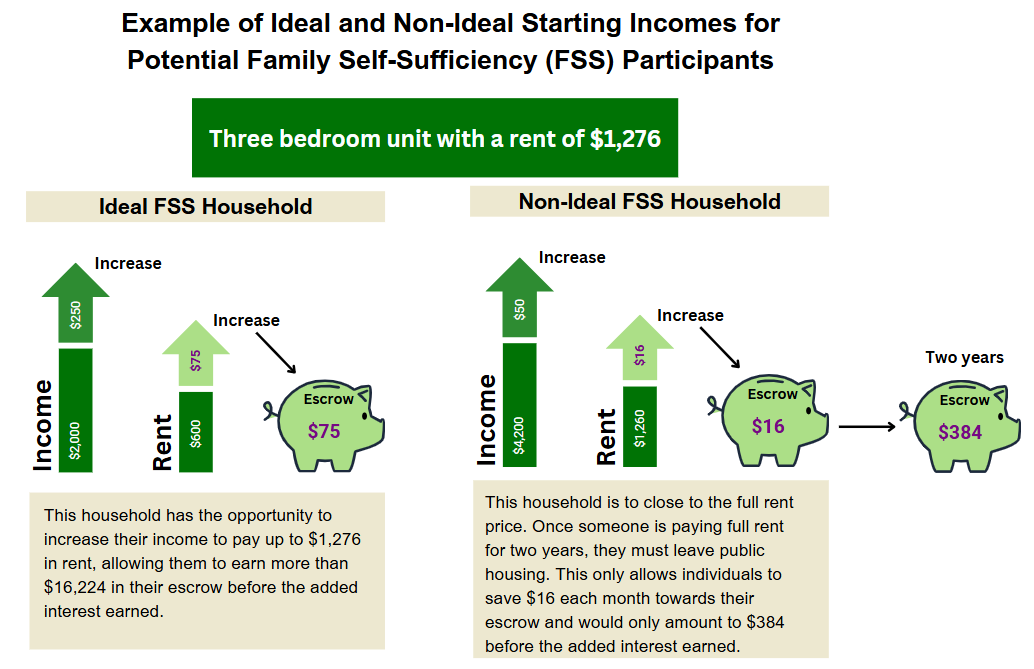

Participants are limited to households that receive a HCV, live in Public Housing or Multi-Family Housing by a housing provider that offers the FSS program. In York, the Housing Authority, Affordable Housing Advocates, and Community Progress Council all offer versions of this program. Only one adult member of the household can enroll in the program.7 The participant is not required to be the head of household. The program is best suited for individuals that are very low income and have the ability to increase their income through employment advancements.7 Households who start with a higher income will have less of a chance to grow their escrow before becoming self-sufficient (see Figure 4).

Figure 4. Example of Ideal and Non-Ideal Starting Incomes for Potential Family Self-Sufficiency (FSS) Participants

Contract and Goals

Participants sign a five year, non-binding contract to participate in the FSS program.16 The FSS coordinator works with participants to identify goals and opportunities within the community that will advance them towards increasing income and owning a home. While the ultimate goal is to be free of public assistance, personal goals are also included. Some common goals are to own a home, acquire a degree or licensing (GED, Associates, etc.), obtain employment, or find a higher paying career.6,7 The contract length is somewhat flexible and can be extended up to two years if significant efforts have been made towards the established goals, but additional time is needed.16 The participant can terminate the contract at any time without penalty. However, participants may only access the escrowed funds if they successfully complete the program.16 They can also dip in with permission from the FSS coordinator to support goals.7 Common approved expenses include uniform costs, car repairs, or textbooks.7 Escrow accounts of participants who exit prematurely or fail to reach the agreed upon goals are reabsorbed into the program.7 The money in the escrow account is provided by grant funding based on the increases the participant pays in rent; therefore, participants are not forfeiting any pay.7,16

Rent & Escrow

Households enrolled in assistance programs pay approximately 30% of their income for rent and basic utilities. When a household’s income increases, their amount paid toward rent increases to reflect 30% of their new income. When a household is enrolled in the FSS program, the difference in the original rent to the increased rent is added to an escrow account.16 An escrow account is a temporary account used by two parties and managed by a third.1 Escrow accounts are designed to hold funds in reserve until a particular, agreed upon, condition has been met.1 Although escrow accounts are not typically interest bearing, FSS accounts do accrue interest and are non-taxable.4,16 For the FSS program, the escrow account is set up by the housing provider when the individual has their first income and rent increase.16 Once the participant has completed the contracted goals, they gain access to the money that has been saved in the escrow account.16 The money can be used for anything that the participant needs, including a down payment on a home, educational enrollment fees, or buying a car.

Local Family Self-Sufficiency Programs

The Housing Authority of the City of York

York County, PA has one public housing authority (PHA), the Housing Authority of the City of York (YHA). The YHA covers the entirety of York County, which has a population of approximately 464,640 individuals and an estimated 178,543 households.15 YHA offers both the HCV program and Public Housing as affordable housing options throughout York County. YHA has approximately 1,402 HCVs available for all of York County and are fully utilized.5 The number of units accepting HCV in York is not publicly available online; however, YHA suggests that landlords list their properties on PAHousingSearch.

YHA estimates that they own and operate approximately 1,066 Public Housing units in York County.5 There are two types of Public Housing in York: (1) Elderly Housing and (2) Family Housing. Elderly Housing is restricted by age and disability status (individuals must be elderly or have a disability to qualify). Family Housing is defined broadly by HUD, designating any group of two or more people who have a history of living together (this definition also includes groups like individuals with live-in aides or cohabitating couples).5 Within these categories there are different communities and scattered site units that are available. YHA owns and operates five family housing communities and some scattered sites, with a total of approximately 611 units.5 As for elderly housing, there are four communities with approximately 530 units total.5

One challenge for YHA’s affordable housing programs is the long waitlists. The waitlist for HCV has approximately 4,600 individuals and will take four to six years to get through.13 Similarly, the Public Housing waitlist has approximately 4,100 individuals waiting.13 In addition, YHA’s Low Income Housing Tax Credit (LIHTC) properties also have a long waitlist, with approximately 5,000 individuals waiting.13

York Housing Authority’s FSS Coordinator is Katelyn Love, who has been in her role since 2016.7 Love has gone through numerous trainings provided by HUD to learn how to help participants establish meaningful and realizable goals and connect participants with local resources to achieve them.7 When speaking with Love, her passion for the position was clear. Reginia Mitchell, Director of the YHA, described Love as “a cheerleader” because of her relationships with clients and her success with helping participants stay motivated to achieve their goals.8 YHA’s FSS program has been successful under Love’s direction. Love shared many success stories about prior participants, like an individual that was able to obtain credentials, land a great job, and collect approximately $21,000 from her FSS escrow to move to a different state where she used her funds to purchase a home.7 Love shared that 31 participants have graduated from the program under her coordination.7 In 2023, a total of $23,945 was given to graduates from their escrow accounts.7

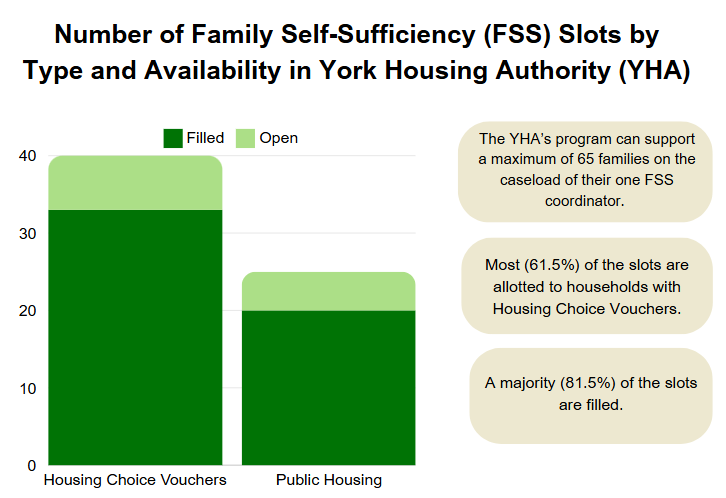

The YHA FSS program has a total of 65 slots for participants.7 40 of the slots are reserved for households receiving HCV, whereas the remaining 25 are reserved for Public Housing residents.7 At the time of the interview, Love shared there were seven openings for HCV recipients and five for Public Housing residents.7 Love hopes that more slots will become available, but it will require additional funding from HUD to allow YHA to hire an additional coordinator.7 Enrollment is key as the grant to expand the program requires demonstration of demand to allocate additional funds for another coordinator.7 With another FSS caseworker, more households and individuals could benefit from the FSS program and gain self-sufficiency.7

Figure 5. Number of Family Self-Sufficiency (FSS) Slots by Type and Availability in York Housing Authority (YHA)

The FSS program is evaluated using FSS Achievement Metrics (FAM) scores.16 FAM scores are composed of three components: (1) participation, (2) graduation, and (3) earnings. The participation score is based on the number of participants enrolled in the program, with a score of ten being the highest. The graduation score is based on the number of participants who graduated within eight years of enrollment, with higher scores being better. The earnings score is based on the growth of income for each household with higher scores being better.17

YHA has a total composite FAM score of 5.60, with ten being the best score possible.17 It is important to note that the components are not weighted equally, with 50% of the composite score being made up from the earned income score; 30% from the graduation score; and 20% from the participation score.17

YHA has a strong participation score, which is an eight out of ten.17 The score indicates that the number of enrolled participants from 2020 to 2022 exceeds the expected minimum number of participants.17 With funding for one FSS Coordinator, the minimum number of expected participants is 25.17 In 2020, YHA had 62 participants in the FSS program.17 According to Love, the number of participants at the time of the interview (July 2024) was 53.7

YHA’s graduation score is a five, which is based on the percentage of participants that were eligible to graduate who graduated within eight years.17 For example, in 2022 a total of 50 participants, enrolled between 2014 to 2017, were eligible to graduate.17 Of those 50, eight graduated making their 2022 graduation percentage 16%.17 Their average graduation percentage was 22% for 2022, 2021, and 2020, which gave them a score of five.17 Since 2005, a total of 89 participants have graduated from YHA’s FSS program.7

York’s FSS participants had an average increase in earned income of $9,033 in 2022; however, when calculating the earned income score the increase in income is controlled for chance by subtracting the increases of income from non-FSS households.17 For example, in 2022 FSS households had an average increase of $9,033 and non-FSS households had an average increase of $4,620, which makes their primary earned income score $4,412.17 After adjusting for Area Median Income (AMI), the earned income score for 2022 was $4,378.17 Their average earned income score was $3,443 (average from 2020 to 2022) giving them a score of 5.17 It is important to note that the income score was likely affected negatively by the COVID-19 pandemic.

When looking at Housing Authorities that had very high composite scores, the Napa County Housing Authority (NCHA) in California stood out. NCHA had a composite score of 9.60 out of ten.17 Their participation score was an eight, with a total of 36 participants in 2022.17 When Chardonia Rose, NCHA FSS Coordinator, was asked about language barriers (something that YHA’s program experiences) she stated that there are limited barriers due to the help from bilingual specialists who aid in translation.12 NCHA had an average graduation rate of 54% for 2020, 2021, and 2022 yielding a graduation score of ten out of ten.17 When asked about their success in keeping participants enrolled until graduation, Rose shared that truly motivating and supporting participants played a large role.12 Additionally, participants in 2022 had an average increase in income of almost $20,000 per year.17 Rose gave all the credit for the increase in income to the participants’ hard work and dedication to improving their employment.12 Rose also shared that she notifies participants of local employment opportunities from community partners and holds quarterly resume workshops to improve participants’ employment opportunities.12 Based on the information provided by Rose, Love and other FSS providers in York are working towards the success that NCHA’s FSS program has had. Local barriers, such as language and job market, may be an extra hurdle that York’s FSS programs face.

Affordable Housing Advocates

The Affordable Housing Advocates in York, Pennsylvania also provides HUD’s FSS program. The Affordable Housing Advocates offer the FSS program to households living in their multi-family housing community, Highland Manor, in Stewartstown, PA.6,14 There are 33 units within Highland Manor.6,14 The Affordable Housing Advocates are new to the FSS game, with their program starting only one year ago.6,14 According to Santiago and Howard, there are currently five participants enrolled and sixth to join soon.6,14 Both Santiago and Howard are hoping that more households will be enrolled in the program by using an opt-out method that automatically enrolls eligible residents unless they choose to opt-out.6,14 This would allow the program to meet its expected minimum of 25 participants.

Santiago and Howard shared that the program recently received a grant that allows potential-participants to be incentivized for enrolling and meeting their goals.6,14 One perk may be gift cards for gas stations or Uber for a participant that enrolls in a GED program; the money towards transportation would encourage them to enroll while also empowering them to attend in person GED classes.6 The grant can also be used to motivate current participants to continue making strides towards their goals. Santiago is positive that incentives will increase enrollment and help participants meet their goals set in the program.14 In addition to grant funding, partnering organizations are essential for the FSS program. Howard shared that finding resources and community partners is a big portion of her current work.6

Barriers to the Family Self-Sufficiency Program

Despite the success of local programs, there are many barriers the program experiences. One of those barriers is language. According to Love, one of the largest barriers that she experiences is language.7 Many of the HCV recipients and Public Housing residents at YHA who are eligible for FSS do not speak fluent English, making it difficult to enroll and maintain enrollment in the program.7 For Howard, language is not as much of a barrier due to a majority of residents being fluent in English.6 However, both FSS Coordinators believe that more Spanish resources are needed to best support FSS candidates in York County.6,7 A contributing factor to the language barrier is the difficulty finding English as a Second Language (ESL) classes that work for FSS participants.7 Increasing the availability of ESL courses, translators, caseworkers, and career development programs can provide significant help to the FSS program and its participants. Similarly, having an additional FSS Caseworker that is fluent in Spanish can help improve enrollment and management of Spanish-speaking residents.

Employment and wages are another barrier to obtaining self-sufficiency. According to a report by the National Low Income Housing Coalition (NLIHC), in order to afford a two bedroom apartment with one full-time (40 per week) job without being cost-burdened (paying more than 30% of income towards housing costs), an individual must make at least $23.02.11 Despite needing to make over $23, most renters in York make only $16.77.11 Nearly 20,000 York County renters are considered cost-burdened.18 According to the York County Economic Alliance (YCEA), several popular industries in York County do not pay a livable wage.18 Examples of these industries include agriculture and retail.18 With many job opportunities not providing a livable wage, it can be difficult to move away from government assistance. These findings indicate that individuals looking to advance in their careers within the FSS program may face difficulty finding higher paying jobs within the current economy in York.

Credit score is another debilitating factor to achieving self-sufficiency.7 No credit score and low credit score can prevent an individual from getting a loan or securing housing. When an individual has low or no credit, getting approved for a home loan can be very difficult. Without a home loan, owning a home is essentially impossible and leaves individuals stuck renting. In addition, getting other loans, such as a car loan, can also be challenging and may leave an individual without transportation to obtain employment. It is not uncommon for a landlord to run a credit check on a potential tenant at the applicant’s expense. If a credit score deemed poor in the landlord’s perspective can result in the applicant not being qualified and out the application fee and a place to live. One way that the FSS program helps participants overcome credit challenges is by connecting them to financial courses.7 Financial courses explain how credit scores work and how to improve a low score or establish credit.

Residing in rural areas, like Stewartstown’s Highland Manor (approximately 30 minutes from the City of York), can create difficulties finding local community partners and resources. Many of the resources are located in York City, which can be challenging for participants to access without a car. In fact, Howard shared that one of the biggest challenges for participants is transportation.6 In many cases, participants do not have a vehicle which leaves them dependent on walking or public transportation. Walking outside of Stewartstown is infeasible due to unwalkable infrastructure and the public transportation system can be unreliable and have limited operating hours. Lack of transportation access is a major hurdle to employment, resources, and access to affordable quality food options.6 Without transportation, participants are restricted to low paying employment opportunities within walking distance of their home. Howard shared that Rutters, Saubel’s (a local grocery store), and a few restaurants are the primary employers.6 Increasing access to transportation can make a big difference in employment opportunities.

A lack of childcare options can create additional barriers for participant success.6 A lack of childcare is a huge barrier to an individual’s ability to maintain employment and attend required classes or meetings.6 Childcare options are scarce across York County and can be extremely costly. Howard shared that a majority of the local childcare options available for the residents in Stewartown had a year wait time; the only childcare option that did not have a wait was run out of an individual’s home.6 Increasing access to affordable quality child care is crucial for many participants to have more opportunities to improve their situation.

The lack of affordable housing creates another barrier to participation and graduation. Finding affordable housing without any assistance is difficult for many households as the average rent in York City is $943 and $1,094 in York County.15 Even with housing assistance it may be difficult to obtain affordable housing due to the four-six year long waitlists.13 YHA are limited on the number of Public Housing units that are available; additionally, the number of vouchers available and units that accept those vouchers remains low. Landlords have to sign up and be approved to accept HCV, the PHA will inspect the unit to ensure safe and decent living conditions. Due to negative stigma around affordable housing, specifically Public Housing and HCV, the addition of affordable units is made difficult. According to Anthony Moore, Chief Operating Officer of Four Squares Development in York, there are negative stereotypes that surround those receiving HCVs or “section 8,” including that participants are lazy or unwilling to work, unable to pay rent, and nuisance tenants that will bring crime or drugs to the neighborhood.9 The reality is that these stereotypes do not represent a majority of HCV recipients, who simply need an affordable place to live.9 Moore shared that these harmful stigmas are one of the main causes for a lack of affordable housing options.9

A significant barrier to the FSS program is the lack of trust that many potential participants may have towards the program.6 The fear of losing benefits and assistance can be a significant hurdle for an individual joining the program. Individuals would need to have trust that they can improve their situation with the help of the FSS Coordinator and program. Additionally, some potential participants may have been scorned in the past by programs that promised to help but did not fulfill those promises or did not offer enough support.6 Howard shared that a potential barrier to gaining trust is her office being located within the management office.6 She feels that participants may be nervous that Howard will tell management about the things that they share.6 Howard emphasized the importance of keeping participants informed of their confidentiality by holding office hours when management is not in the office or by scheduling meetings in participants’ homes (if they are comfortable with that).6 Both Howard and Love conveyed that building trust and a feeling of support is essential for helping FSS participants.6,7 Both are passionate about helping the households in their communities gain confidence and success in the program.6,7

Conclusion

The FSS program is vital to help individuals achieve the American Dream of owning a home. The program provides much needed help in establishing a savings account that can be used for emergencies, a downpayment on a home, or anything the participant may need to gain self-sufficiency. The program is essential for helping individuals move out of poverty and into prosperity. The FSS program helps exemplify that individuals utilizing housing subsidies are working to better their situation. FSS participants defy the unfair stigma that Section 8 and Public Housing residents are lazy and want to remain dependent on the welfare system by increasing their income and achieving their goals.

If you think your organization has anything to offer for participants in the FSS program, please contact:

• Anna Howard – Stewartstown – anna@ahadvocates.org | 717-993-6541

• Katelyn Love – York City – KLove@yorkhousing.org | 717-845-2601 X1301

Kristie Houck is the Urban Collaborative Scholar-in-Residence at York College of Pennsylvania (YCP). During her time at YCP, Kristie has focused on housing research in York City. She is expected to graduate in May 2025 with a Masters of Public Policy and Administration (MPPA). Previously, Kristie’s professional experience was working with at-risk youth and their families involved in Children and Youth Services. Kristie can be found on Linkedin.

References

1. Banton, C. (2024). How escrow protects parties in financial transactions. Investopedia. https://www.investopedia.com/

2. Center on Budget and Policy Priorities. (2020). Basic facts about HUD’s family self-sufficiency program. https://www.cbpp.org/research/

3. Compass Working Capital. (n.d.). FAQs: Escrow account management. U.S. Department of Housing and Urban Development. https://files.hudexchange.

4. Housing Authority of the City of Napa. (n.d.). Family self-sufficiency FAQs. City of Napa. https://www.cityofnapa.org/

5. Housing Authority of the City of York. (n.d.). Family self-sufficiency. York Housing Authority. https://yorkhousingauthority.

6. A. Howard, personal communication/interview, November 2024

7. K. Love, personal communication/interview, August 2024

8. R. Mitchell, personal communication/interview, August 2024

9. A. Moore, personal communication/interview, September 2024

10. Morris-Louis, M. (2023). Helping renters build assets and move out of poverty by scaling HUD’s best kept secret. Brookings. https://www.brookings.edu/

11. National Low Income Housing Coalition. (2024). Out of reach: The high cost of housing. https://nlihc.org/oor

12. C. Rose, personal communication/email, October 2024

13. Santiago, J. (2024). Stable Housing Collaborative’s Introductory Event. In-person presentation.

14. J. Santiago & B. Lindstrom, personal communication/interview, October 2024

15. United States Census Bureau. (2023). QuickFacts: York County, PA; York City, PA. https://www.census.gov/

16. U.S. Department of Housing and Urban Development. (n.d.). Family self-sufficiency (FSS) program. https://www.hud.gov/program_

17. U.S. Department of Housing and Urban Development. (2022). FAM 2022 workbook final. https://www.hud.gov/sites/

18. York County Economic Alliance. (2023). York County housing needs and conditions assessment. https://www.yorkcountyeap.org/